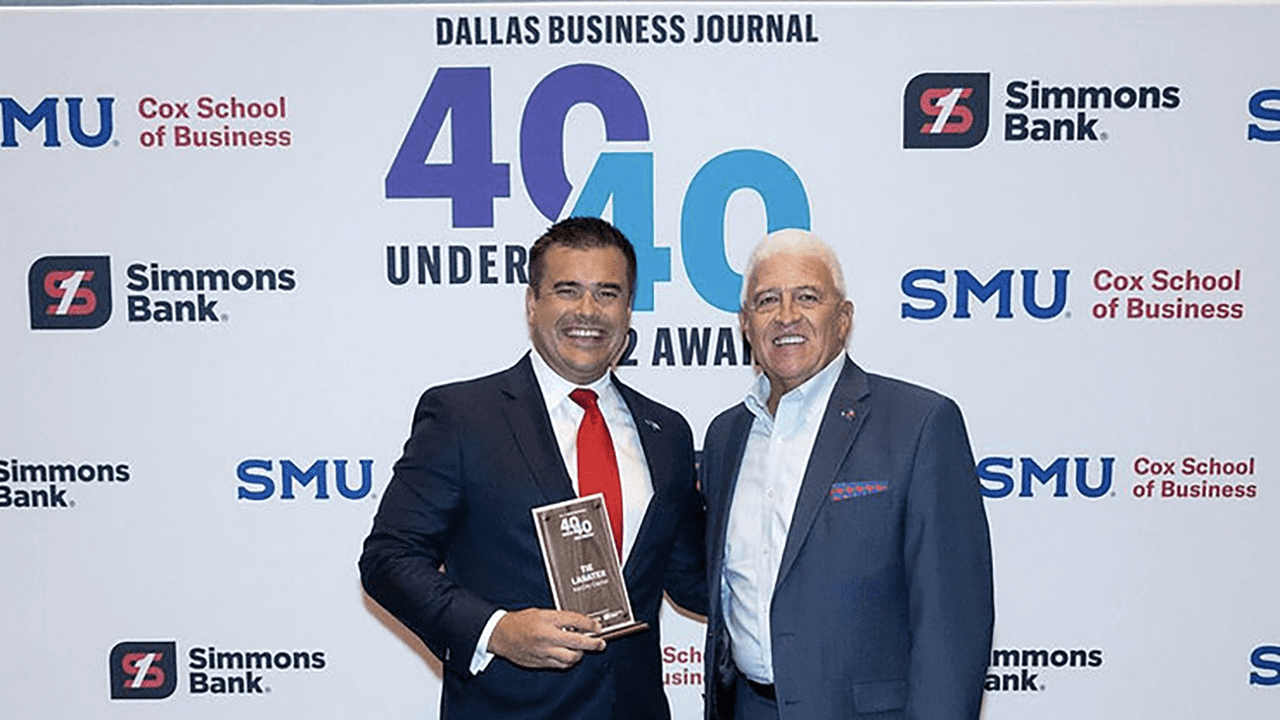

Tie Lasater, founder and Chief Executive Officer of KeyCity Capital, has been named a DFW top 40 Under 40 business leader for 2022, as announced this month by the Dallas Business Journal.

The publication notes that recipients of the prestigious award “represent innovation and excellence in their fields and are making valuable contributions to our community.” It adds that this year’s honorees “have helped shape our community in various ways making DFW a better place to live and do business.” The announcement follows another DBJ accolade for KeyCity Capital, as the company was recently recognized by the journal as a Best Place to Work among growing DFW-area companies.

“These recognitions are a truly meaningful tribute to our team,” said Tie Lasater. “Our team members join us because they want to be a part of something that treats people well, and we are committed to that promise, whether it be to employees or to our clients and business partners. I am very grateful for these acknowledgments.”

As CEO and a managing partner for KeyCity Capital, Lasater is a member of the International Investing Hall of Fame and is a real estate entrepreneur and speaker with business interests across multiple countries and continents. He and his partners have acquired hundreds of millions of dollars in real estate properties across the United States, making KeyCity Capital one of the Dallas-Fort Worth region’s leading private equity and wealth acceleration firms. The company’s mission of connecting capital to wealth is accomplished via a focus on income-producing, affordable housing in target-specific markets, combined with careful diversification in alternative asset-backed investments intended to generate cash flow and double-digit returns.

Lasater graduated from Abilene Christian University and is a Southlake resident with his wife, Karah, and their three children. The family is passionate about philanthropy and is actively involved in supporting causes ranging from assistance to young single mothers to support of orphaned children in the United States, Africa, and China. They are currently in the planning stages of an orphanage they are working to build in East Africa.

Tie Lasater has been described by Celebrity Apprentice Judge George Ross as “the person you want to be involved with if you are looking to build a successful real estate business.” KeyCity Capital has been nominated for Inc. 5000 awards for “Best in the Business” and “Most Innovative Companies.” The firm has a proven track record with more than ten years of experience in real estate and alternative investments, and its clients/partners have never experienced a loss of capital or a missed distribution.

He and his partners have acquired hundreds of millions of dollars in real estate properties across the United States, making KeyCity Capital one of the Dallas-Fort Worth region’s leading private equity and wealth acceleration firms.