Stability. Markets like the word. Whether we are discussing inflation, interest rates, elections, or employment rates, markets prefer stability over variability. The same can be said of most of us when discussing personal preferences.

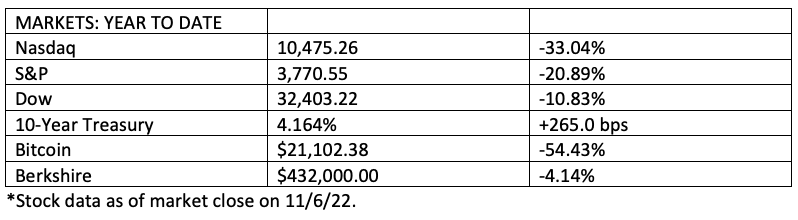

The first nine months of 2022 have certainly seen a lack of stability in each of these areas. Markets have reacted harshly in response to an abundance of interest rate hikes, an uncertain election cycle, and a labor force that has been difficult to quantify.

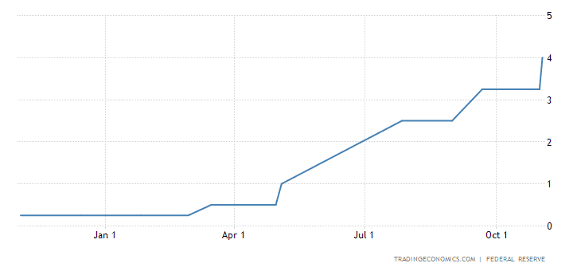

Federal Reserve Chair Jerome Powell made the unprecedented move of a fourth consecutive rate hike of .75% earlier this month. This brings the current federal funds rate to 3.75%. It is widely speculated that there will be another .5% increase in December—marking the most aggressive rate increase in the history of the Federal Reserve. The Fed has publicly stated that they plan to have the federal funds borrowing rate at 4.25% by end of year.

Federal Interest Rates: January 1-October 31, 2022

Increases in the federal funds rate makes borrowing costs more expensive for the consumer. One year ago, the average 30-year mortgage rate was approximately 3.0%. As of November 11, 2022, the average 30-year mortgage rate is approximately 7.25%. The difference on a $300,000 mortgage at these rates is an approximately $800 per-month increase. This increase is how inflation is brought under control through the increased cost of borrowing money. The same will hold true for auto loans, personal loans and credit card finance charges.

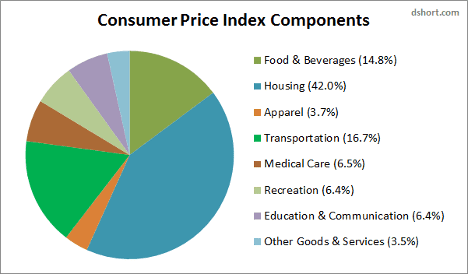

Inflation continues to be a topic of interest. At the time of this writing, the consumer price index (CPI) rose an additional 0.4% in October 2022, despite the interest rate increases, according to the U.S. Bureau of Labor Statistics. This number is a month-over-month comparison of the cost of goods and services. In fact, housing, food, and transportation costs make up 73.5% of the index. As gas prices, rents, and food costs increase, so does the monthly CPI.

At KeyCity Capital, we believe there will be a small decrease in inflation through the end of Q4 based on reduced consumer demand. However, without additional relief in the form of a national energy policy focused on supply side economics, it will be difficult to achieve a meaningful reduction.

We’d like to close this installment with a quote from Ronald Reagan that we feel summarizes our current economic condition quite well. “Inflation – That’s the price we pay for those government benefits everybody thought were free.”

Here’s to a productive 4th quarter!